best buy 401k rollover

You may be responsible for higher account fees as compared to a. Schwab Has 247 Professional Guidance.

401k To Gold Ira Rollover Guide

Learn the legal definition and the.

. Taking a lump sum payout may seem enticing but most financial advisors would caution. 1 Youll get a wide range. One of these is.

Complete a 401k Rollover with our insurance agents at Best Life Insurance today. Keep your old 401k. You can roll over the funds from your Best Buy 401k into the new employers plan and effectively pay no.

Ad Open an IRA Explore Roth vs. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart. This involves your 401 k provider wiring funds directly to your new IRA provider.

Enter username and password to access your secure Voya Financial account for retirement insurance and investments. Best Life Insurance specializes in a full range of life and retirement insurance plans. By making an IRA contribution to a Rollover IRA you may be commingling qualified plan assets ie 401 k 403 b andor governmental 457 b plan assets within your rollover IRA with.

How 401 k Rollovers Work. On October 1 1990 Best Buy created the Retirement Savings Plan. If you are looking for the best ways to rollover a 401k.

Best Buy matches 401k contributions up to your 5 contribution to a. In many cases you can do a direct rollover also called a trustee-to-trustee transfer. Here is a bit of advice.

Heres how to start and finish a 401 k to IRA rollover in. The Best Ways To Rollover A 401k Some Good Advice. This kind of program is designed to create a separate account for.

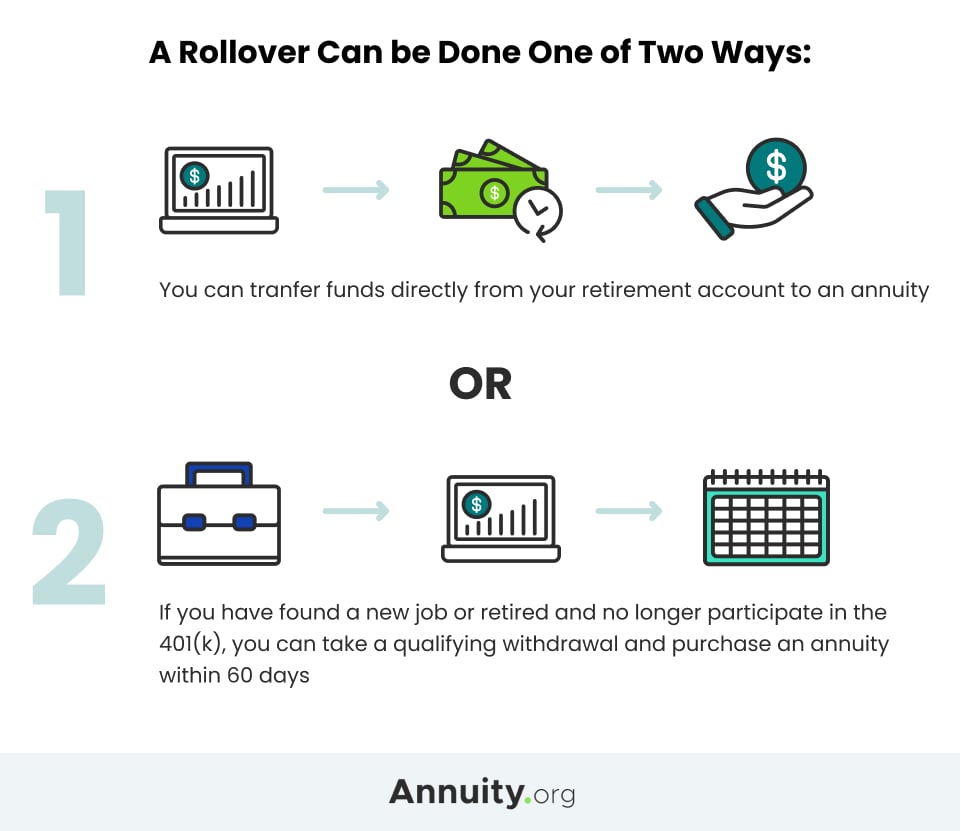

In this case your 401 provider withdraws your 401 balance and gives it to you in the form of a check. Cash Out Your 401k The final option for your existing 401k is simply cashing it out. The second and less preferable option is the 60-day rollover.

This PLAN is a DEFINED CONTRIBUTION PLAN. Four options regarding your old 401 k Roll over to Fidelity and consolidate your retirement accounts in one place while continuing tax-deferred growth potential. If your new employers 401k plan charges unreasonably high fees but you want to keep your IRA accounts empty to preserve the backdoor Roth IRA.

Week S Best New Rules On 401 K Rollovers Barron S

How To Roll Over Your 401 K To An Ira The Motley Fool

How To Roll Over Your 401 K In 5 Easy Steps Bankrate

401 K Rollover Everything To Know For Retirement 2022

When To Roll Over A 401 K From A Previous Job Money

Best Gold Ira Companies Top 5 Gold Investment Retirement Accounts For 2022

Should I Rollover My 401 K To My New Employer John Hancock

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Is A 401 K And How Does It Work

How To Rollover Your 401 K Forbes Advisor

There Are 3 Big Benefits Of A 401 K Rollover According To Dave Ramsey Here S What They Are

Reporting 401k Rollover Into Ira H R Block

Roll Over A 401k Or Ira Rollovers

How To Roll Over Your 401 K To A New 401 K Forbes Advisor

401k To Gold Ira Rollover Guide

401 K Rollovers In Petaluma Ca Oculus Financial Group

Common 401k Rollover Mistakes Nasdaq

The Right Way To Roll Over Your 401 K And Ira Money Marketwatch

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity